knoxville tn sales tax rate 2020

County and city taxes. The local tax rate varies by county andor city.

Tennessee Car Sales Tax Everything You Need To Know

Local tax - see local tax chart.

. The local tax rate may not be higher than 275 and must be a multiple of 25. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes. Tax sale dates are determined by court proceedings and will be listed accordingly.

The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. The sales tax rate does not vary based on zip code. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Lebanon TN Sales Tax Rate. The average cumulative sales tax rate in Knoxville Tennessee is 925. The latest sales tax rate for Knoxville IA.

House located at 1100 Chickamauga Ave Knoxville TN 37917 sold for 182000 on Mar 3 2020. The state general sales tax rate of Tennessee is 7. 3 beds 2 baths 2020 sq.

3 beds 25 baths 2885 sq. This rate includes any state county city. The Knoxville sales tax rate is.

Maynardville TN Sales Tax Rate. The sales tax rate on food is 4. Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax.

The Tennessee sales tax rate is currently. The Tennessee sales tax rate is currently. Local Sales Tax is 225 of the first 1600.

You can print a 925 sales tax table here. You can print a 925 sales tax table here. The general state tax rate is 7.

The 925 sales tax rate in Knoxville consists of 7 Puerto Rico state sales tax and 225 Knox County sales tax. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax. The TN sales tax applicable to the sale of cars boats and.

The Tennessee sales tax rate is currently. Free Unlimited Searches Try Now. The general state tax rate is 7.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. The local sales tax rate and use tax rate are the same rate.

Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district. The December 2020 total local sales tax rate was also 7000. View sales history tax history home value estimates and overhead view.

The December 2020 total local sales tax rate was also 9250. All local jurisdictions in Tennessee have a local sales and use tax rate. Although the majority of property owners pay their taxes on time the five or six percent that do not force us to take extreme measures.

The purpose of tax auctions is to collect delinquent revenues and put properties back into productive use. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Knoxville IA Sales Tax Rate.

Jackson TN Sales Tax Rate. The Knoxville sales tax rate is. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is 9250. State tax - The general sales tax rate for most tangible personal property and taxable services is 7. Within Knoxville there are around 31 zip codes with the most populous zip code being 37918.

For tax rates in other cities see Tennessee sales taxes by city and county. The local tax rate varies by county andor city. The current total local sales tax rate in Maynardville TN is 9250.

2020 Brice St Knoxville TN 37917 279900 MLS 1201900 2020 Brice is a Fantastic 3bdrm 2bath Home with Many Renovations including. What is the sales tax rate in Knoxville Tennessee. The latest sales tax rate for Knoxville TN.

The state of Tennessee also announced that for 2020 only on the weekend of Aug. There is no applicable city tax or special tax. A few products and services such as aviation fuel or telecommunication services have different tax rates.

Use tax rate - same as sales tax rate. And prepared food including restaurant meals and some premade supermarket items are charged at a. This includes the rates on the state county city and special levels.

Knox County TN Sales Tax Rate. The current total local sales tax rate in Knox County TN is 9250. This is the total of state county and city sales tax rates.

Generally the sales tax applies to the retail sale of tangible personal property and certain services such as lodging services. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The current total local sales tax rate in Knoxville IA is 7000.

There is no applicable city tax or special tax. The Knox County Sales Tax is collected by the merchant. This is the total of state county and city sales tax rates.

You can print a 925 sales tax table here. Please click on the links to the left for more information about tax rates registration and filing. For tax rates in other cities see Puerto Rico sales taxes by city and county.

31 rows Hendersonville TN Sales Tax Rate. For tax rates in other cities see Tennessee sales taxes by city and county. The sales tax is comprised of two parts a state portion and a local portion.

The December 2020 total local sales tax rate was also 9250. The December 2020 total local sales tax rate was also 9250. Knoxville is located within Knox County Tennessee.

Ad Get Tennessee Tax Rate By Zip. The County sales tax rate is.

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

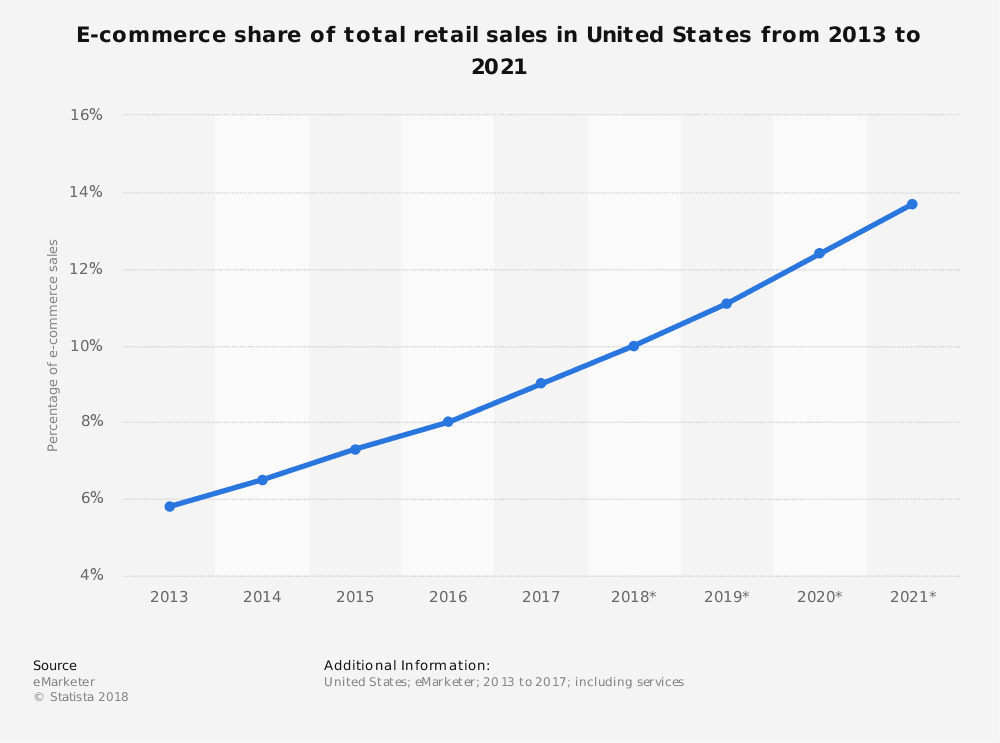

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Tennessee Sales Tax Small Business Guide Truic

Tennessee Income Tax Calculator Smartasset

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

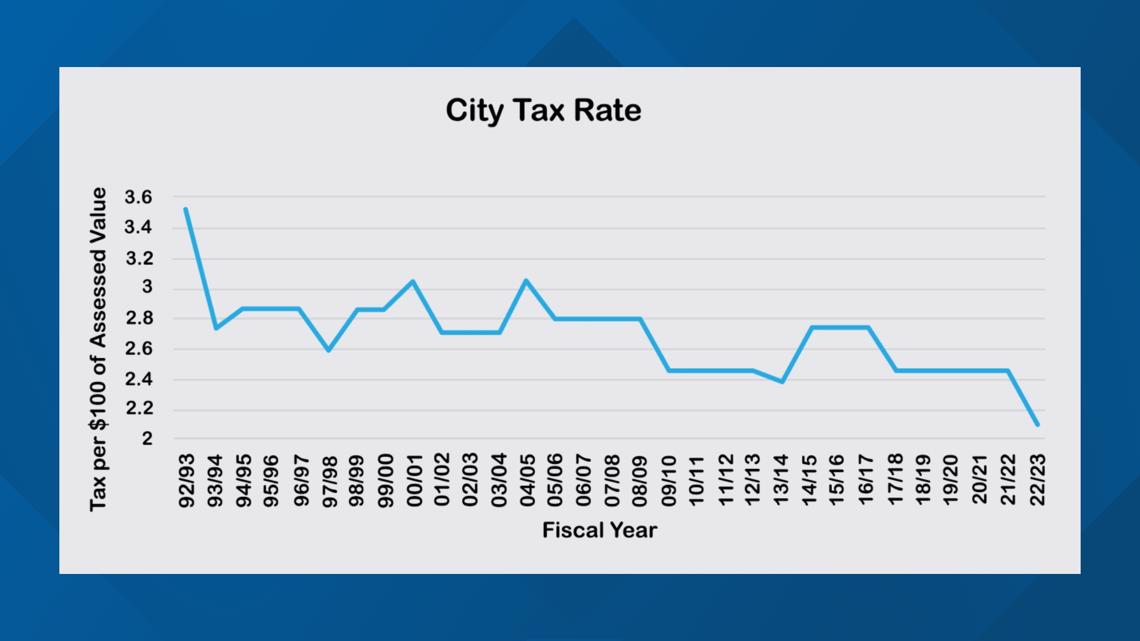

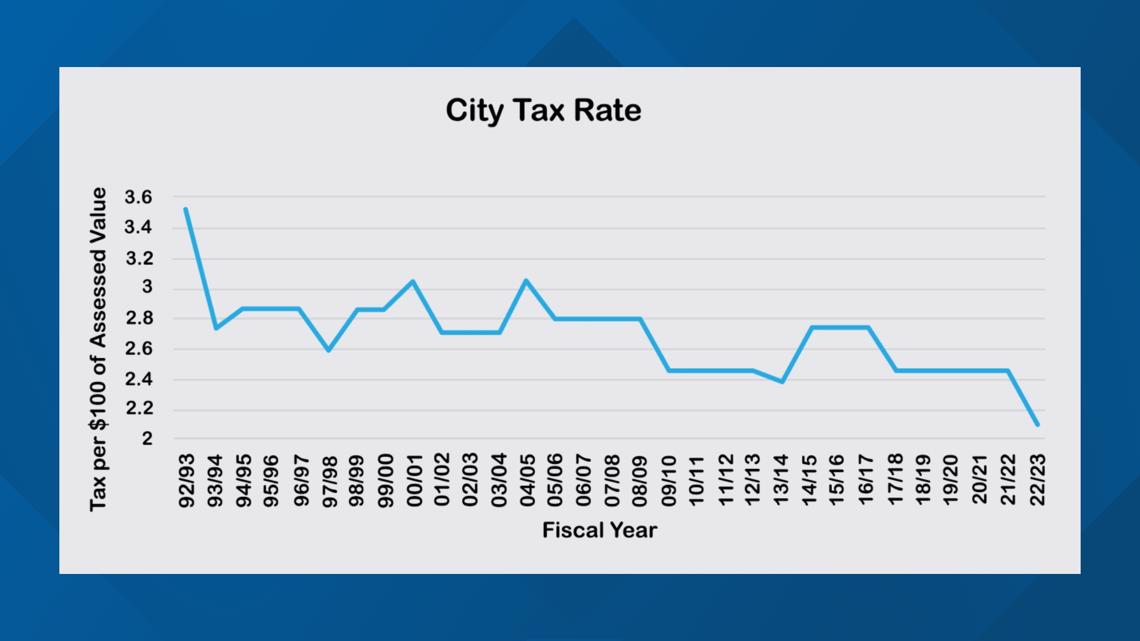

Knoxville Mayor Proposes Lowest City Tax Rate In 50 Years Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue